|

INDIVIDUAL TAXPAYERS - NEW PENALTY RULE

During January and February 2022, SA Revenue Services started charging individuals, administrative penalties for the late submission of income tax returns in terms of the Public Notice 1531 (issued 26 November 2021) which was split into the following:

- Late submission of tax returns for 2021 tax season

- Late submissions of one or more tax returns for 2006 - 2020 tax seasons

With the commencement of the late submission administrative penalty during January 2022, the differences between the taxpayers’ provisional tax obligation and the standard working operations of the SA Revenue Services have come to the forefront.

When is a provisional taxpayer identified?

The Fourth schedule of the Income Tax Act 1962, places the burden upon the taxpayer to establish whether there is an obligation to submit a provisional tax return and make the required provisional tax payment, during each tax year.

However, in practise, SA Revenue Services only determines whether the taxpayer meets the definition of a provisional taxpayer, once a taxpayer has submitted their income tax return for the respective tax year, that is to say, upon assessment of the taxpayer.

Taxpayers that are registered as provisional taxpayers, received once off administrative penalties for late submission of their income tax returns. SARS basis for the penalty is that the returns were submitted late, even though the deadline for provisional taxpayers was only on 31 January 2022.

On further analysis and after engagement with our professional controlling body SAICA, it appears the late submission penalty has been being triggered by the SA Revenue Services system where the taxpayer has selected the provisional tax ‘tax type’ and submitted provisional tax returns on e-Filing, but does not technically meet the definition of “provisional taxpayer” as set out in the Fourth Schedule to the Income Tax Act, 1962, upon assessment of the income based on the income declared in the tax return.

In most instances, this ‘disqualification’/ exclusion appears to be as a result of the R30 000 threshold on certain income types (i.e., rental income, interest and dividends), in terms of paragraph (dd)(BB), which provides for an exclusion from the “provisional taxpayer” definition -that is, the person meeting the requirements of this paragraph will not be regarded as a provisional taxpayer.

Practical implications

Taxpayers can no longer by default be classified as provisional taxpayers, but need to continuously evaluate their status based on their actual taxable income for every specific tax year in order to avoid administrative penalties.

What’s new this year? selecting the provisional tax type on e-Filing and/or submitting provisional tax returns (IRP6 returns) does not qualify someone as a provisional taxpayer

What is an Administrative Penalty?

An Administrative Penalty (Admin Penalty) is a penalty levied under Section 210 of the Tax Administration Act (TAA). The Act prescribes the various types of non-compliance which are subject to fixed administrative penalties.

Currently the penalty is imposed in respect of individuals for the following types of non-compliances:

- Once-off administrative penalties for –

- Taxpayers that were selected for auto assessment but failed to accept, decline or edit and then file their and

- All provisional and non-provisional taxpayers that were not auto assessed and submitted a return after the deadline date.

- Recurring administrative penalties for –

- This type of penalty will be imposed where the taxpayer has failed to submit a return as and when required under the Income Tax Act for years of assessment commencing on or after 1 March 2006 and where that person has two or more outstanding income tax returns for such years of assessment; The penalty will be levied for every month the return(s) remains outstanding for a maximum of 35 months.

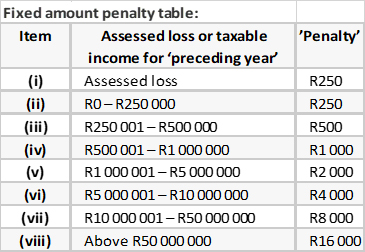

The administrative non-compliance penalty for either the failure to submit a return, or late submission of a return comprises fixed amount penalties based on a taxpayer’s taxable income and can range from R250 up to R16 000 per month for each month that the non-compliance continues.

|